by theEmother | Feb 15, 2022 | EXIT execution, exit strategy, Finish Unfinished Business, how to sell a business, Sell Your Business

from PART 1…

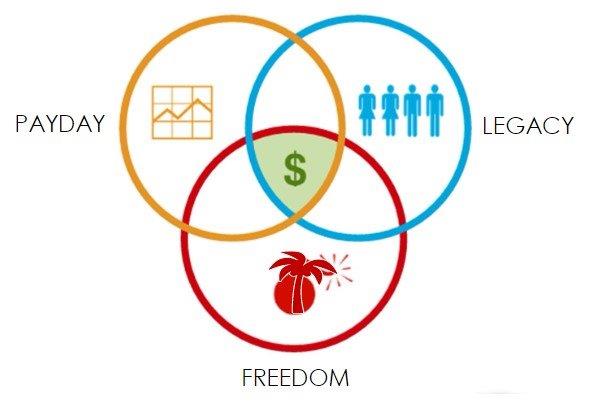

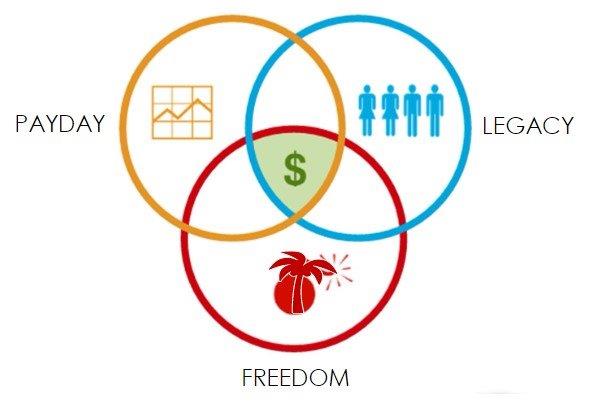

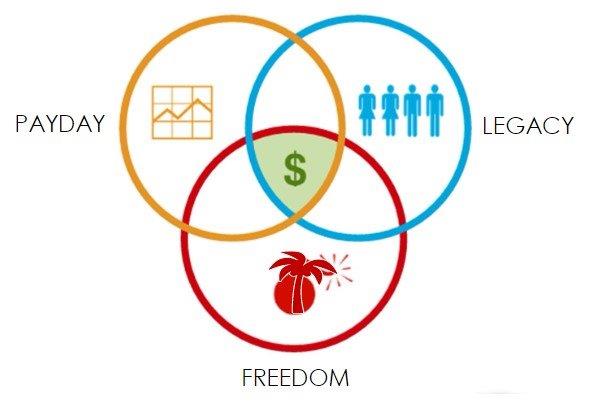

In my experience, there are typically 3 reasons why an Owner/s is looking to sell:

1. PayDay

2. Freedom

3. Legacy

PayDay is where it all starts. It is after all the most tangible. How much is it worth? How much does the Owner want? How big is the gap? What can be done about it?

And sometimes, it can be where it ends. What is the deal? Terms and conditions? Is this the best we can expect/except? Time to move on…

However, what I’ve come to learn is that Freedom and Legacy definitely play a strong hand in the final outcome. It’s just that no monetary value can be placed on just how instrumental these are.

PART 2 (continues…)

Make no mistake, by going down this path, the Business Owner is starting to warm to the idea of how to Exit with Dignity…How this impacts all people (whether family or not) related to the business must also be taken into account. But ultimately, it is the Business Owners decision and no one else’s…

Whilst price, PayDay, is a primary deciding factor, what only concentrating on this cannot do is assist the Business Owner in determining “when is the right time to sell MY business?”. And all others around will have an opinion on this too.

Other factors outside of the business sale scope may influence this decision in relation to how personally ready the Business Owner is to move on. These are often the tipping point of which no monetary value can be attributed, summarised as “Freedom” to do other things and “Legacy” so the business continues, just not by the current owner.

In other words, how badly does the Business Owner want the:

• PayDay – to set themselves (and family) up financially?

• Freedom – to do other things, the next add-venture perhaps?

• Legacy – for the business to continue (maybe within family), without being at the helm?

To get to the heart of these is paramount, and begins to address Exiting with Dignity.

That said, asking direct questions such as these outright of a Business Owner may not result in the depth of answer required. Instead, there are a number of less targeted ones, which can decipher the clues of readiness. Depending on the depth of relationship of the questioner with the Business Owner will dictate which of these is more appropriate to use.

PayDay:

Are you in a good place? Is the business?

Is the worst behind you? The business?

Who else needs to be included in this conversation?

How much are you prepared to reveal about the true situation of the business? And to whom?

Can you afford to sell?

How are you replacing the cashflow you’re about to sell?

Are you personally well-structured financially?

How much money is enough?

Is the business profitable?

Is the Tax man coming?

What is the asset, that is your Business, worth?

What is this value based on?

Are the business financial statements clean and clear?

Freedom:

Are you excited about something else? The next thing?

Is your luck going to continue?

Do you have Freedom now?

Can the business operate without you?

Do you want to spend more time with family? Do they want to spend more time with you?

What is the longest holiday you have been able to take?

What happened to the business?

Are you prepared to stay on for a period of time post sale? Family members? Key employees? How long?

How will perceived risks be mitigated?

What are your non-negotiables?

Legacy:

Are you becoming less interested in fighting on?

Do you want the business to continue?

Does the business need to continue?

Does the business have family, staff, suppliers and customers to look after?

Will family care?

Will customers care?

Is there a steady flow of new customers? How is this happening?

Do you need to be there?

Is the business sustainable?

Is the business unique or positioned favourably enough to survive?

Lots of stock? Old or new?

Lots of stuff? Old or new?

Or, to summarise, one question to ask to get the conversation started would be “what will you do if you don’t sell?”.

Amidst the aftermath of the pandemic, with some time left to play out, this type of personal reflection is well-timed given how for some Business Owners this prolonged uncertainty may have taken its toll on the individual and the family and those nearest and dearest to the business… If you want to start talk to me, send an email…

by theEmother | Jan 15, 2022 | EXIT execution, exit strategy, Finish Unfinished Business, how to sell a business, Sell Your Business

Having recently spent an afternoon engrossed in the movie “House of Gucci”, one particular word that I paid attention to throughout was “LEGACY”. The notion of leaving something (upon your Exit) to be proud of, for the next generation/s (whether this be family or not) to continue and build on, was certainly one of the key storylines. Even though the Gucci story, in particular, turned ugly and lethal, the notion of Legacy for many other Business Owners does not appear to get the level of consideration it deserves, especially if there is no family member willing to take up the mantle when the Owner will/can not.

In addition, during one of the 2021 Melbourne-style lockdowns, I spent some time catching up on the latest from Changethis.com, with Decoding Family Business striking a chord. Not so much in terms of the insights, it provided (which I also agree with) but more about the greater meaning and therefore impact of “family”, whether the actual family members work in the business or not. Working with many businesses of all shapes and sizes over 10 years of Business Brokering, my view is that all business is a “family” business.

“If you’re part of such a [family] business or working for one, the business’s uniqueness will be no surprise to you. But that doesn’t mean you always understand how and why the business operates the way it does.”

Or even how decisions are made. Or whether, as a long-term employee, you should be included in some decisions, especially when it impacts your future directly… like the Exit of the Business Owner for example.

As noted in Decoding Family Business “… family businesses have three defining characteristics:

-

Some individuals, especially owners, have a huge impact.

-

Family businesses are held together by relationships, which are multidimensional and interlocking.

-

Everyone’s behavior is shaped by system dynamics, some of which you may not even realise.“

Remove the word “family” in regard to these points, and you could be talking about most small businesses going about their work, possibly in silence, where individuals can also be long-term employees (as opposed to direct family).

To be able to really unpack the desires and feelings of the Owner and associated loved ones is paramount to a successful sale of the business when it comes to Exit. But, so is the importance of the impact on long-serving employees, and customers, and suppliers. Each of these may ultimately influence the Business Owner, whether explicitly or not, in the details of the deal being agreed and the subsequent signing of a Contract of Sale in terms of formalising the decision.

Where long-serving employees, and customers, and suppliers are not family, even though sometimes they may be referred to as such, they are nonetheless the community that keeps the business alive and ticking. And it’s highly likely that they do/will have a vested interest in what happens to the business when it’s time for the Owner to move on.

Part of the Art of being a good Business Broker (which you must be to last 10 years in this industry) is to fundamentally understand the driving forces behind the decision-making within the business context, especially at Exit time.

In my experience, there are typically 3 reasons why an Owner/s is looking to sell:

-

PayDay

-

Freedom

-

Legacy

PayDay is where it all starts. It is after all the most tangible. How much is it worth? How much does the Owner want? How big is the gap? What can be done about it?

And sometimes, it can be where it ends. What is the deal? Terms and conditions? Is this the best we can expect/accept? Time to move on…

However, what I’ve come to learn is that Freedom and Legacy definitely play a strong hand in the final outcome. It’s just that no monetary value can be placed on just how instrumental these are. To not apply the respectful amount of consideration in regard to how the Exit will impact those closest to the business, and who it will impact can come back and bite the Owner, just when they’re hoping for smooth sailing…

(PART 2 continues…)

by theEmother | Jun 23, 2021 | how to sell a business, Sell Your Business, SELL your Mother of a Business, women in business case studies

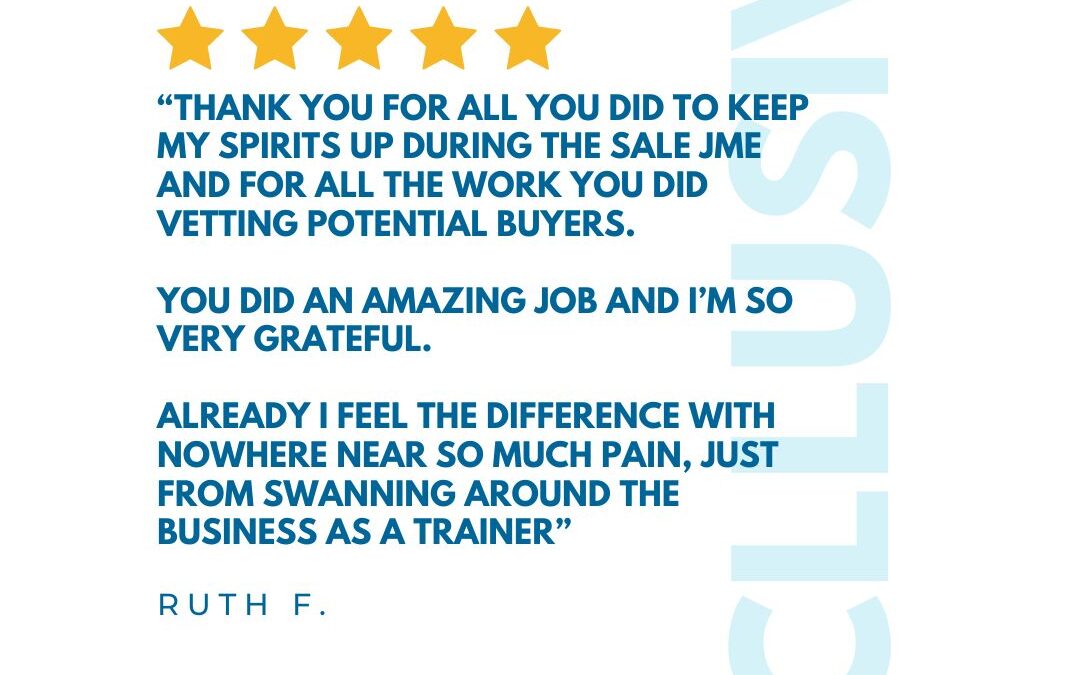

Such a pleasure working with this Vendor, and getting the BUSINESS SOLD. Even though at times it got a little tough, the end result is #happyvendor #happybuyer #happybroker – what more can we ask for!

#xcllusivebusinesssales #sellbusiness #buybusiness

by theEmother | May 14, 2021 | exit strategy, how to sell a business, Sell Your Business, SELL your Mother of a Business

SOLD: Just the word needed to confirm that the next phase of a Business Owner’s life is about the start, with the past add-venture coming to an end. As you can appreciate, the buyers need to be equally as pleased. Ready to explore the same?

This particular transaction took 12 months to complete, slowly chipping away through Lockdown and COVID restrictions over 2020, to be able to finally settle in January 2021. The business sold was a small consultancy, so very important that the chemistry of the people involved worked equally as well as the mechanics of the deal.

Happy Buyer, Happy Seller and Happy Broker.

#sellbusiness

#buybusiness

by theEmother | Feb 1, 2021 | business ideas & thinking, EXIT execution, exit strategy, Finish Unfinished Business, how to sell a business, Sell Your Business, SELL your Mother of a Business

As explored in “Business is Personal; Small Business and Owners – a Love Letter” earlier this year, Small Business can be the most wonderful and fulfilling business-life partner you’re looking for.

And sometimes it is not…

When it comes to business, we like to think we are strategic and thorough in our approach. We want to believe we know where our talents and opportunities lie, we spend years (and a fortune) on gleaning advice and (maybe) attending training and professional development, we devote all our collective energies to progressing, keeping a vigilant and jealous eye on the progress of our rivals.

Consequently, when (as a business owner) we’re ready to exit, it should be the easy bit.

We don’t expect there to be any particular complexity in this part of the plan. We’ve decided we want to relax and have fun, and envisage the only obstacles to such goals might be finding the right buyer, so that the business is sold for a song. We adopt an almost laissez-faire, she’ll-be-right-mate attitude, and readily take up suggestions of others without rigorous scrutiny, sometimes, without thinking about things too much at all really.

What becomes painfully obvious when we do get serious is that is what we’ve missed for many years. We fail to note that our business is so much more that just-a-business and not worth nearly as much as we think we deserve, because we insist on being haphazard and even slow about the planning and execution of the Exit. We stick to being guided by internet searches, hearsay, unlearned opinions and muddled instinct when we should be harnessing reason and independent advice from those who play in this space. We end up being a lot more miserable than we might be because we have not taken this part of the business lifecycle more seriously.

And we don’t because we assume that what worked for others will work for us too.

It doesn’t readily occur to us to take our unique situation, both in terms of the business itself and what it means to us and our family and our staff and our suppliers and our customers and our community overall, into account. But most of all, personally and individually.

We’re always looking for clues as to when to even acknowledge the question of Exiting the Business in the first instance, and then when to think about actioning it. Here are 7 to get started:

- No Longer Enjoyable: some owners may not enjoy operating the business any more.

Whilst this might seem simplistic, it’s not. If we’re finding it’s a struggle to do what we once did with joy – why? is it the business itself? is it the people we are working with? is it what’s happening at home impacting on our workplace? Have we found something new to tickle our fancy? Are we just over it? Do we want to leave a legacy that is represented by our business, continuing well into the future, but want someone else to take the reins?

- Personal Debt: successful businesses can be sold to pay off owners personal debt.

Have we found ourselves in a position where we’re staying awake at night worrying about the amount of debt we’re carrying and/or meeting the repayment regime? Is the business the one asset that could be sold that will address this, freeing us up from the burden and for our next add-venture? Is it a choice between the business or the family home?

- Capitalisation: to reap the dividends for many years of hard working by capitalising.

“Capitalisation of profits implies plowing the money back into the business, or keeping it on the balance sheet for some future, yet-unidentified opportunity, or to return some or all of the profit to its shareholders, in the form of cash dividends or new shares” (investopedia.com) Do we really want to sell, or just be able to get some hard-fought-for funds out? Is selling shares a way to do this, and to eventually move the business on over time? Is it a way to at least share the load?

- Ill Health: the owner may need to sell on health grounds.

We’ve had a health check and the feedback is not what we wanted to hear. What do we do now? Do we put the business on the market tomorrow? Do we think all will be right and not worry about it? Do we start making calls to work out what options we have over what timeframes? Do we remonstrate ourselves for not having the business in a more saleable shape?

- Limited Potential: not seeing potential or poor performance.

What future does our business have? Is our business ready to take on new initiatives? Is it in an industry on the decline or incline? Can it be reworked, repurposed, recycled, or refurbished? Do we know what to do to bring it into the 21st century but don’t have the energy or the care factor? Do we not know what to do, and not really sure which way to turn or who to pay attention to? Is this as good as it’s going to get for the foreseeable future, and therefore now would be the time to move it on before there’s more deterioration?

- New Project: owners may want to free up time to pursue a new project in mind.

Freedom plays a big part in thinking about Exit. If we didn’t spend all our time running our business, what would we do instead? What could we do instead? What have we learnt through being a business owner that we can now apply to another path? What angle in our existing business have we discovered that excites us more? Would we actually prefer to be doing something completely different?

- Work/Life Balance: balancing work with life, or maybe even retirement.

Maybe we’ve just had enough…

We want more balance, whatever this means for us.

We don’t want to die with our particular appetites and intense sensations tragically unexplored.

If we use ourselves as our point of reference, what would our life without the business look like? What would we talk about?

How would we identify ourselves? to others?

What have we enjoyed in the past and might we recreate?

What might we learn to say no to and contrastingly, to emphasise going forward?

What’s becoming evident to us as the Business Owners that we are, is that what’s been happening of late (or for the last number of years) cannot continue. Even if we’ve done well, we probably can’t just shut the business down without affecting and upsetting many others, and maybe we don’t really want to do this either. So what are the real options?

Selling the business is definitely one…

If any or all of these possible considerations are resonating, it’s time to work out what to do. If 2020 has taught us nothing else, it has highlighted how something can come out of nowhere and completely disrupt our world, whether we’ve been fabulous folk, excellent at business, or otherwise.

Let’s put this learning to good use…

Call me +61 3 8560 0524

by theEmother | May 5, 2020 | buy | sell websites, Buy a Mother of a Business, exit strategy, Finish Unfinished Business, how to sell a business, Sell Your Business, SELL your Mother of a Business

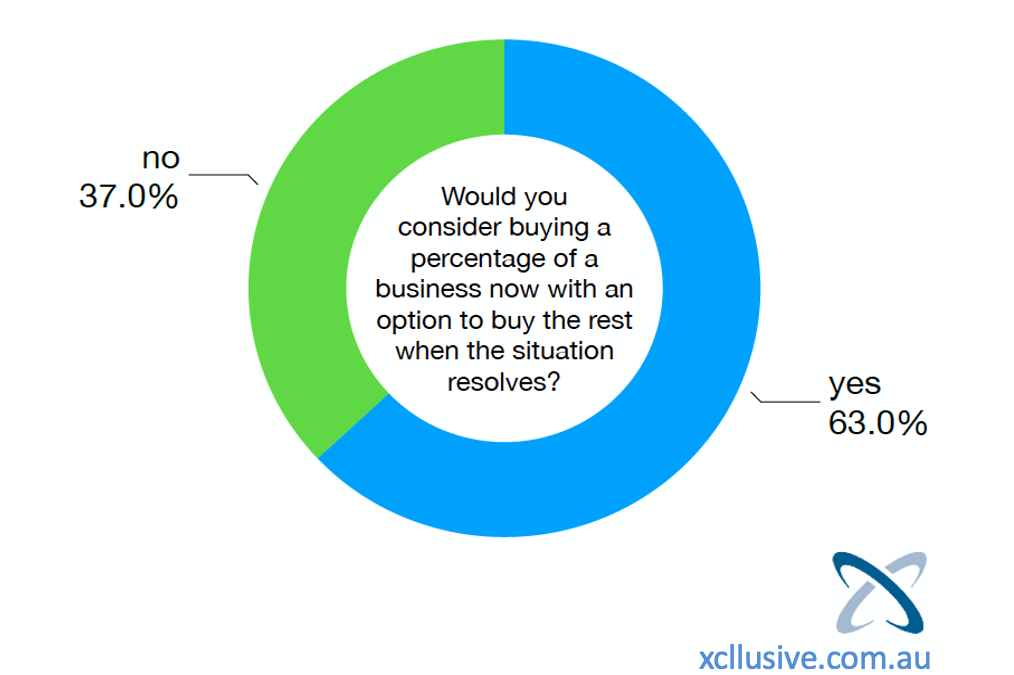

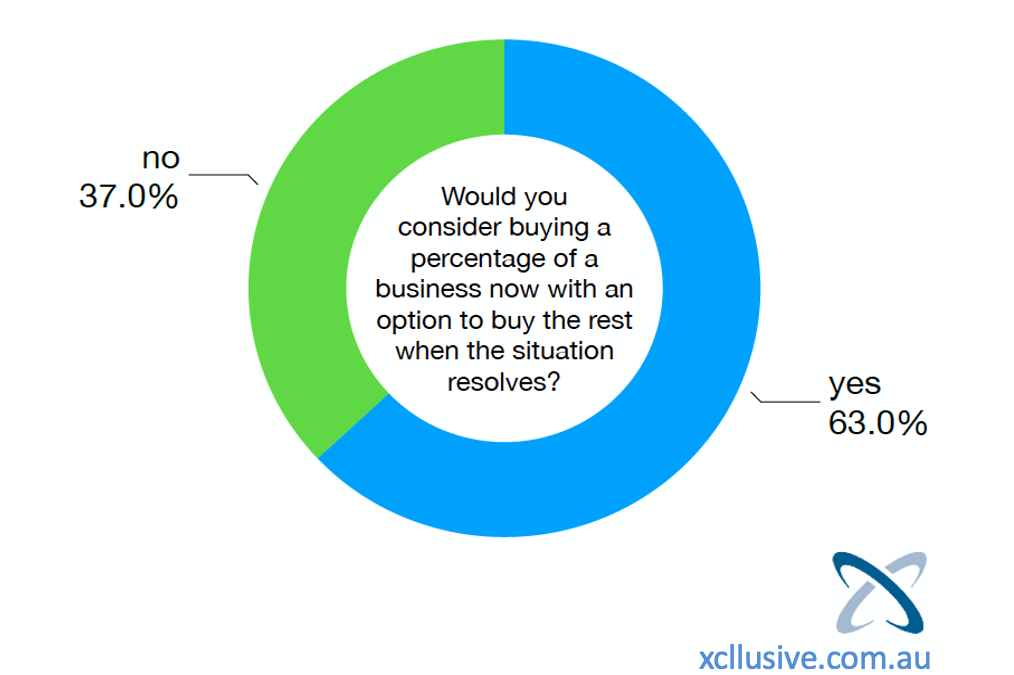

The answer is YES for 63% of those we asked, based on this questions “Would you consider buying a percentage of a business now with an option to buy the rest when the situation resolves”?

(Q8 from the Xcllusive Business Buyers Report – April 2020)

We saw a little of this pre-COVID 19 but expect this method to increase in the future. It means the buyer and the seller will share the risk. This is very encouraging for the future.

Complimentary to this: What are the characteristics that will compel you to buy in this environment?

- Low fixed overheads relative to sales level

- Good forward plan

This is something business owners can do now to prepare their business for sale.

If you’re considering selling, have a really good look at your overheads – there’s never been a better time to renegotiate and reduce your overheads. Create a short but solid forward plan using bullet points to show the direction of your business..

To find out what else Buyers has to say, go here to read the full Report.